Paying online with virtual cards has long become the norm of digital security. These cards can be issued in one minute without visiting a bank, and can be closed or reissued without bureaucracy if something goes wrong or plans change. Minimal paperwork, modern security technologies, favourable conversion rates — virtual cards have plenty of advantages. And all of them make virtual cards the most practical tool for online payments.

In 2026, virtual cards with no spending limits deserve particular attention. They not only offer all the benefits of digital payment tools, but also allow users to expand how these cards can be used. They are suitable for paying for luxury cruises, booking hotels and villas, and for shopping. In this article, we break down which unlimited solutions are offered by international providers of US dollar cards.

The most popular international financial brands: the best solutions in 2026

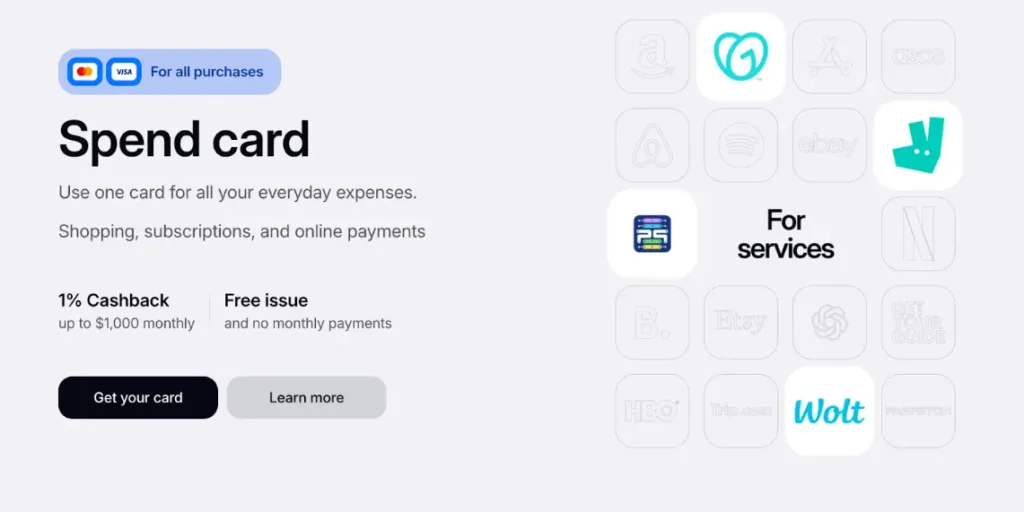

Spend.net

Cards from the Spend.net platform are leading the way. The platform mainly issues cards for media buying, but regular users can choose standard cards with a set spending limit. This is especially convenient and secure, as only the cardholder knows the limit. At the same time, a card can be created specifically for a particular purchase.

All cards on the platform are free, and payment cards are issued with 1% cashback by default. All card transactions are also protected by 3D Secure technology.

The provider is simple to onboard and easy to manage. For the KYC procedure, only a passport is required, and all instructions are displayed on screen. Deposits can be funded in crypto. Users can set the top-up fee themselves; however, the rule applies — the larger the deposit, the lower the fee you can choose. The minimum is 2%. The service does not charge fees for other operations, and it is especially beneficial that every transaction is processed with a 0% commission.

To issue a card from Spend.net, it is enough to complete a qui ck registration via email or Google ID. It takes no more than one minute and does not require personal attendance. For any questions, users can contact support via the personal dashboard.

PSTNET

The PSTNET platform and its cards are also very popular. The platform issues virtual cards for a wide range of purposes, allowing users to choose a card for any scenario. Each Ultima card works in the same way as the other cards on the service (based on Visa and Mastercard systems) but has no limits on spending or top-ups. Users can independently define their spending level and use the card for as long as needed. Many people use this type of 3D Secure virtual card to pay for bookings and premium purchases. An important detail is that user data security is ensured by two-factor authentication and data protection technologies.

To get started with the service, users can download the app or register on the website. Authorisation is available in various ways — via Telegram, using a Google account, or any other method. KYC is fast and requires only a passport. Deposits can be funded in any convenient way — using crypto (with an impressive choice of coins), or in the standard way via bank transfer or card top-up. The top-up fee is fixed. All card payments are processed without fees or commissions. For maximum benefit, the Ultima card can be paid for annually, with a discount applied.

Karta.io

Many users also speak highly of the Karta platform. The service issues virtual cards from US banks and was originally designed as a platform for businesses and media buying teams. For standard user needs, Visa cards with 3D Secure protection and crypto top-ups are available.

To get started, Telegram is required. Registration and card issuance are handled through a Telegram bot, which can also be used to manage cards and track spending. The KYC procedure is quick and also takes place via the Telegram bot. Balance top-ups are made in crypto, with support for several of the most popular currencies. The top-up fee is dynamic and depends on the user’s individual terms. On average, it is 1% + $15 per deposit. There are no fees for payments. Additional advantages include fast Telegram-based support available 24/7.

Ezzocard

The Ezzocard service does not issue unlimited cards, but operates on a model of unlimited prepaid card issuance. These cards can be purchased on the website without registration or documents. Cards with a $2,000 denomination are available and can be bought in any quantity. Payment can be made using cryptocurrencies or simply with a card. A small service markup applies to the cards, but all payments made with them are processed with no commission.

In short, the platform is ideal for those who value privacy and speed of issuance. However, for paying for something serious, the platform’s cards are, of course, not suitable.

Final thoughts

In 2026, virtual cards remain one of the safest and most convenient ways to make online payments. They provide full control over funds, help plan spending precisely, and protect against unexpected charges. The next step is unlimited digital cards with crypto top-ups and all the advantages of modern payment tools.

Complete freedom to spend and manage your finances — now without limits.