Use Gratuity Calculator UAE Online

Gratuity refers to a statutory monetary reward that an employer is under obligation to make, upon termination of employment. It pays the employees for the service provided and provides financial assistance upon quitting the job.

Eligibility for Gratuity

Gratuity in the UAE is given to the employees who have served one year of continuous service. Employees can be of full-time or part-time, but the calculation may vary depending on the terms of the contract and the duration of service.

Types of Employment Contracts and Their Effect

Gratuity is subject to the type of contract. Two main types exist:

- Limited contracts are instituted with a fixed time period and terminate on a given date.

- Unlimited contracts are open-ended and either party can terminate them under particular conditions.

It is also important to know your type of contract since there is a difference in the calculation of the two types of contracts.

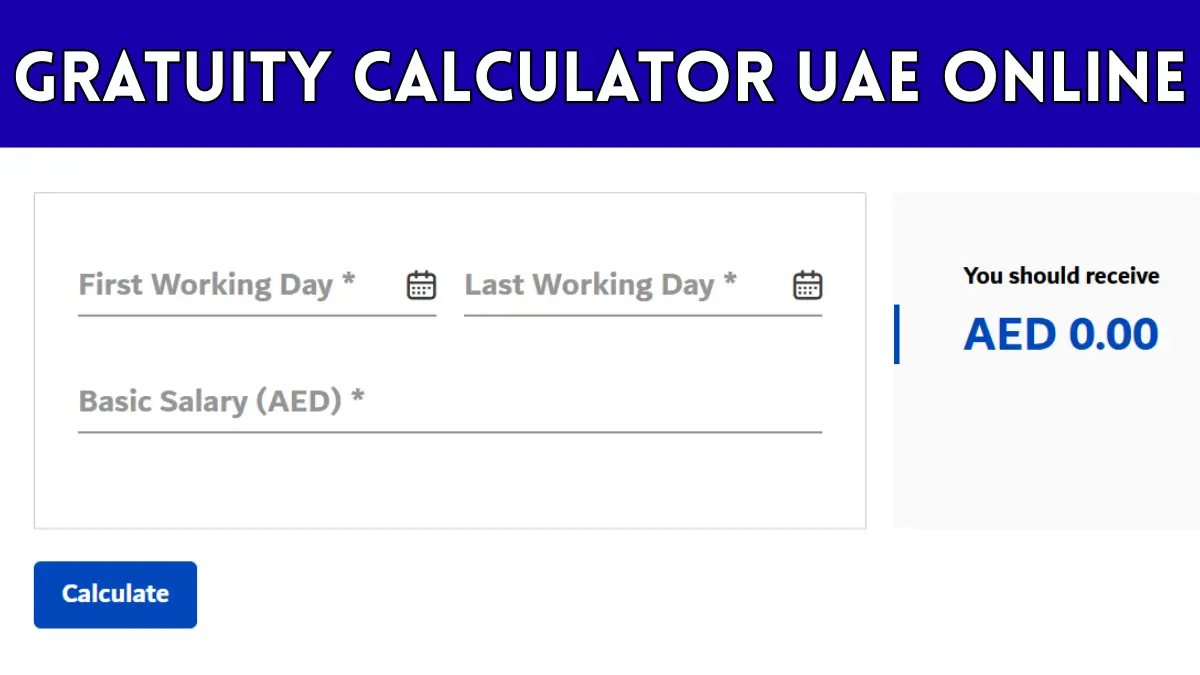

Calculation with Gratuity Calculator UAE

The calculation will involve the basic salary of the employee and service. The rule is amended after every five years.

Simple Computation Formula of Gratuity

- During the initial five years: 21 days basic salary per annum.

- After five years: 30 days basic salary per annum.

Computation of Gratuity on Limited Contracts

The same formula is used for employees on limited contracts. They, however, will not receive their entire gratuity if they terminate the contract prematurely unless the employer agrees otherwise.

Calculation of Gratuity on Unlimited Contracts

Workers under unlimited contracts are also given gratuity based on their service years without a penalty on premature termination if the employee has not committed any wrongful acts.

Illustration of Gratuity Calculation

An example is where an employee has a basic salary of AED 5,000 per month, and works for six years.

- First five years:

- 21 days of salary per year = (5,000 ÷ 30) × 21 = AED 3,500.

- Total for five years = 3,500 × 5 = AED 17,500.

- Sixth year:

- 30 days of salary = (5,000 ÷ 30) × 30 = AED 5,000.

- Total gratuity = AED 17,500 + AED 5,000 = AED 22,500.

The Most Important Areas of Influence on the Calculation of Gratuity

The final amount depends on a number of factors. These are to be considered to determine the correct calculations:

- Length of Service:

- The more time you enjoy your stay, the more gratuity you get. It is 21 days during the first five years, and 30 days after that.

- Basic Salary:

- Only the basic salary counts. Other allowances like housing or transportation are not included.

- Additional Benefits:

- Although not included in the computation, other benefits may enhance your general financial status when you retire. Other companies provide additional benefits to the severance package.

- Break in Service:

- When there is a gap between contracts, the time is not normally counted. It is essential to have continuous service.

- Contract Type:

- Small contracts can lose gratuity in case of an early departure. Unlimited contracts usually give full gratuity in case of termination irrespective of the reason.

Gratuity Calculator Tools in the United Arab Emirates

It is made easier by online calculators. They calculate your right to it depending on the information provided.

The Use of a Gratuity Calculator UAE

You need to fill in your basic monthly salary, total time of employment, and whether your contract is limited or unlimited. The calculator will subsequently give an estimated amount of gratuity.

Popular Websites to Calculate Gratuities

Some of the reliable websites allow you to compute UAE gratuity:

Such tools are time-saving and provide an accurate estimate of what you are entitled to.

Errors to Avoid in Calculating Gratuity

These mistakes should be avoided to achieve a proper outcome:

- Incorrect Interpretation of Employment Contracts:

- When all contracts are assumed identical, one may make an error. Check on the existence of a limited or unlimited contract.

- Wrong Salary Information:

- When the wrong salary is used and the allowances are included, the outcome will be distorted. Use only your basic salary.

- Disregarding Part Years of Service:

- Even those workers who work half an annual year deserve pro-rated gratuity. For example, 2.5 years of service will produce half the bonus for the half year.

- Excluding Certain Benefits:

- Watch out against adding additional allowances or bonuses. They are not included in the computation of gratuity, but they influence the total compensation.

Gratuity Payment Process

When and How is Gratuity Paid?

It is also customary to pay gratuity along with the final settlement on termination. The payment is received in the same month in most cases, but again, this will depend on the employer.

Gratuity Taxation in the UAE

The greatest benefit of UAE employment is the fact that gratuity is tax-free. There are no deductions, and employees are given the full amount.

Claiming Gratuity

In case you leave a company voluntarily, you can get gratuity through your employer. In the event of any conflict, consult a lawyer or refer to the Ministry of Human Resources and Emiratisation.

Gratuity vs. Pension: The Difference

Gratuity and pensions are used differently:

- Gratuity is a lump sum that is paid once the employment has ended.

- Pensions are long-term plans of savings that employees contribute to during their career and are given after they have retired.

Gratuity may be used to complement other retirement plans such as pensions and may be used temporarily when someone is in the process of changing jobs.

Conclusion

Gratuity is a means of life-blood financial security for UAE employees. Learning how it is computed, the most critical aspects which impact its result, and relying on the helpful calculators will guarantee that you get all the amount you deserve. Both employers and employees gain the advantage of proper calculations, record-keeping, and adequate contract review.

FAQ’s

What is the highest amount of gratuity in the UAE?

The maximum days of service for gratuity is thirty days of monthly salary per year of service beyond the first five years.

Will the resignation of my job be considered a show of gratitude?

Yes. In the case of resignation, you are entitled to gratuity, as per the length of service and type of contract.

Are part-time employees subject to gratuity?

Yes. Pro-rated gratuity is provided to part-time workers.

What would happen to me when I do not get my gratuity payment on time?

Take the matter to the Ministry of Human Resources and Emiratisation to address the matter.

What is the difference between the UAE gratuity calculation when I work in a free zone?

The majority of free-zone workers are subject to the same laws of gratuity without exception, as long as their agreement does not state otherwise.

Is the calculation of gratuity inclusive of allowances?

No. Calculation is carried out only using the basic salary.

Is it possible to compute gratuity when I put in fewer than a year?

Yes, based on a pro-rated basis of the period worked.

Is the gratuity taxable in UAE?

No. Gratuity is not a taxable item.

What is the manual math of calculating my gratuity?

Divide by years: 21 days per year for the first five years, and 30 days per year for the other years.

Is it possible to claim gratuity when a contract is over?

Yes. The gratuity is claimable once the contract is over, whether it was terminated voluntarily or not.

Related: NBAD Balance Inquiry